All stakeholders must own, take responsibility to adopt Islamic financial system: Expert

Pakistan can develop and reshape its economy and financial system based on Islamic principles, provided the state and all stakeholders demonstrate absolute acceptance and support for the purpose. The executive, legislature, judiciary, policymakers, regulators, media, clergy, political parties and market players should demonstrate the willingness, take responsibility to adopt Islamic financial system.

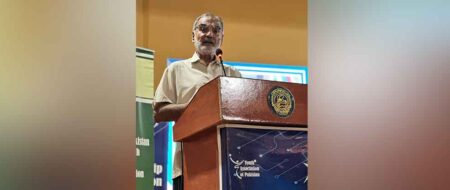

This was emphasized by Farrukh Raza, Group CEO at UK-based Islamic Finance Advisory and Assurance Services (IFAAS) and co-founder IFN Services, during a detailed presentation on ‘Road Map for Conversion Towards Islamic Financial System in Pakistan: Enabling Mindset and Strategies’, held at IPS on August 31, 2023 as part of a project on mapping the Islamization of Pakistan’s economy.

Raza emphasized the need for government policies and legislation to transform the finance industry in line with Islamic principles, urging federal and provincial governments to create policies and enact laws reshaping the legal framework. To maintain the integrity of Islamic finance practices, robust regulatory supervision, corporate and Shariah governance laws, capacity-building initiatives targeting stakeholders, and raising public awareness are crucial for promoting a comprehensive understanding of Islamic finance, he added.

The transformation journey involves exploring sovereign funding tools like Sukuk, adjusting financial institutions to align with Islamic principles, and integrating Islamic funds with the economic development needs of the country, he stated.

Raza said that despite prevailing challenges, establishing Islamic finance is certainly feasible in Pakistan. The Islamic finance industry can achieve tremendous development; for that, obstacles must be overcome with dedication, coordinated efforts, and a clear plan, he added.

Commenting on the crucial role played by stakeholders in the successful implementation of an interest-free system, he referred to the case of Malaysia. He stated that the unanimous acceptance of Islamic finance principles by stakeholders, particularly religious scholars, has been a key factor in developing the Islamic finance industry and attaining financial inclusion in Malaysia.

In 2015, Raza informed, he and his team provided Indonesia with a national master plan for conversion, outlining targets, action plans, timelines, ownership, oversight, and testing protocols to strengthen Islamic Finance presence. This plan received the approval from the Indonesian parliament, and, through a presidential decree, concrete actions were set in motion. Five years later, the share of Islamic Finance doubled, with hopes of further increasing from 10 to 20 per cent in the coming years. Notably, it is imperative to highlight that the Indonesian president himself took a keen interest in the plan, personally overseeing its progress, ultimately contributing to the master plan’s success.

He further mentioned that Pakistan needs the unequivocal willingness and cooperation of stakeholders, including government institutions, industry players, media, religious scholars, and regulators, to create an environment conducive to developing an Islamic economy and financial inclusion.

Islamic banks have a responsibility to create mass awareness and dispel public doubts about Islamic banking practices from the minds of the public, a task not achievable by the clergy or government alone, Raza stressed.

The Islamic banks and other financial institutions in Pakistan should form a consortium that allocates funds through their marketing and CSR budgets for public education on Islamic economic system and financial practices, addresses collective mistrust, and advances Islamic social finance capacity to address economic needs, Raza demanded. He lamented that the industry is not doing enough to create mass awareness and sensitize the policy circles on the issue.

On the recent advancements in the modes of Islamic social finance for poverty alleviation in the Muslim world, Raza lamented the regressive attitude of the traditional clergy in Pakistan that lacks the motivation for ijtihad to address the needs of the society in the changing times. There is a need for programs that involve Ulema in interactions with countries excelling in this area, initiating awareness and capacity building campaigns. These programs should also facilitate discussions on various Fatawa concerning Islamic financial products in different countries, ultimately benefiting from their practices.