‘SBP’s Policy Rate: Bane or Boon for Pakistan’

Full Reserve Banking advised for eliminating inflation, debt, and interest rate problems

In Pakistan, debt servicing is one of the biggest challenges that every government has to face and it is growing constantly due to the prevailing policies. As per the federal budget 2023-24, 60% of the government’s revenue is used in debt servicing. This issue is prevailing due to the controversial monetary policy of the State Bank of Pakistan. The share of debt servicing in consuming revenue is higher than the other state entities.

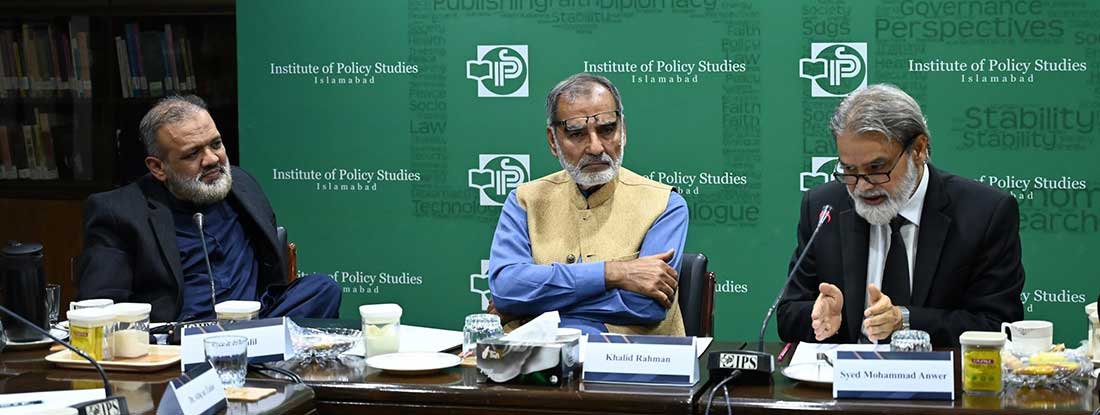

These views were shared by Qanit Khalil, chartered accountant & economic analyst, while making a presentation during a session titled ‘SBP’s Policy Rate: Bane or Boon for Pakistan’, which was organized by IPS on 1st December 2023. The presentation was followed by an insightful discussion which was partaken by prominent scholars and practitioners including Khalid Rahman, Chairman IPS, Justice Dr Syed Muhmmad Anwer, Aalim Judge Federal Shariat Court, Dr. Muhammad Tahir Mansoori, Former Vice President, IIUI, Dr. Atiquzzafar Khan, dean, Faculty of Social Sciences & Humanities, Riphah International University, Dr Anwar Shah, Associate Professor, School of Economics, Quaid-i-Azam University, Dr Tahir Hijazi, Former Vice Chancellor, Muslim Youth University, Ghazala Ghalib, Lecturer IIUI, Naufil Shahrukh, GM Operations, IPS. The session was moderated by Muhammad Wali Farooqi, Research Officer, IPS.

Khalil said that debt servicing in Pakistan has risen alarmingly, escalating from Rs 200 billion in 2003-04 to an astonishing Rs 7,300 billion in 2023-24. Surprisingly, a substantial 90% of this expenditure is directed towards servicing domestic loans, benefitting banks and their depositors disproportionately, thereby adversely affecting the common man. To cope with the exorbitant interest resulting from the SBP’s controversial high-interest rate policy, the Government of Pakistan (GoP) has accumulated an enormous amount of domestic loans, marking a tenfold increase from Rs 4.6 billion in 2010 to 37 billion presently. This surge in domestic debt, coupled with an expansion in money supply, has contributed significantly to high inflationary pressures in the economy.

Facing challenges in obtaining loans from commercial banks, the GoP resorted to injecting self-created money into the economy, placing additional burden on commercial banks. This has led to inflationary pressures, impacting the overall economic landscape.

The consequences of this policy have been further aggravated by a subsequent increase in the policy rate by the SBP from 7 percent in June 2020 to 21 percent in April 2023, with the aim of containing inflation.

Presenting the solution of the problem, Khalil pointed out that Islam has indicated two rules for the system, one is to implement the system of Zakat on government level, i.e. Government should collect the Zakat from the masses of community and distribute among the poor and the other is to eliminate the Riba from the economy. This system can be achieved through implementing the Islamic Banking. Islamic banking, also referred to as Islamic finance or Shariah-compliant finance, refers to financial activities that adhere to Shariah (Islamic law). Two fundamental principles of Islamic banking are the sharing of profit and loss and the prohibition of the collection and payment of interest by lenders and investors.

Full reserve banking has garnered support from notable economists such as Keynes, Hayek, and Friedman, Khalil added. In this system, banks serve as intermediaries between savers and borrowers; however, the crucial distinction lies in the power of money creation. Advocates argue that the authority to create money should be solely vested in the central bank, akin to the issuance of new currency notes.

In a full reserve system, the responsibility for issuing deposits rests exclusively with the central bank, and private banks are precluded from money creation. Unlike the current practice where credit is generated based on deposited amounts, a full reserve system mandates the separation of credit and money. Under this framework, no credit is created on deposits, and loans are not extended against the deposited amount. This approach aligns closely with the principles of Islamic banking, emphasizing a distinct and conservative financial model.

During the discussion, consensus emerged among the participants as they concurred with the presenter’s perspective. It was widely acknowledged that the prevailing government approach of elevating the policy rate to impede economic activity faced considerable challenges, primarily attributable to the substantial size of the informal economy in Pakistan. The discussants agreed that the traditional measures had limitations in the Pakistani context. Moreover, there was a unanimous recognition of the significance of the full reserve banking model. Participants articulated that this concept is foundational and aligns seamlessly with the principles of Islamic banking, underlining its potential to provide a robust and alternative framework for the country’s financial system. The discourse emphasized the need for a paradigm shift, considering the current economic landscape of Pakistan.