Federal Budget 2020-21: My Impression and Takeaways

Proposed budget depicts lack of creative thinking to address economic challenges: IPS webinar

The government can only improve its revenue side by creating an environment conducive for economic activity especially in the current unprecedented challenging external and internal circumstances. However, the budget presented by the federal government shows severe lack of any well-thought-out approach in policy- and budget-making in the turbulent times Pakistan is faced with.

These views emerged at a webinar on Federal Budget 2020-21 organized by Institute of Policy Studies (IPS) on June 15, 2020.

Khalid Rahman, executive president, IPS said that the country is experiencing extraordinary circumstances and in this situation some innovative ideas were expected in the proposed budget. Addressing the economic challenges the country is experiencing needs out-of-the-box thinking to boost revenue generation, he stressed.

He deplored that the country’s actual problem is governance deficit, which is going from bad to worse. “Examples of this can be seen in the petrol shortages and healthcare issues during the pandemic,” he said.

Zaheeruddin Dar, former civil servant, and economic policy analyst expressed his concern that a 27 per cent increase in FBR revenue was unrealistically expected in the budget. The FBR tax collection target has been set at Rs4.963 trillion while the revised estimate of the closing year was Rs3.908 trillion. In the current situation even collecting Rs3.500 trillion would be a miracle, he remarked.

He said all FBR revenues are consumption related including sales tax and customs duty. Tax collection will not increase without generation of economic activity. “More revenue cannot be collected just by hiking tax rates,” he added.

Over the years Pakistan has not invested in those sectors that can generate additional revenue. He said education, health and economic infrastructure are the three sectors that provide enablement to those economic sectors that generate revenue.

He said the country’s consumption pattern is changing. The lower middle income and lower income groups are highly sensitive to inflation and their consumption patterns change immediately. The government must protect the lower middle income and lower income groups even at the cost of higher income groups.

Mirza Hamid Hasan, former federal secretary, water and power also seconded Dar stating that the government has projected a 27 per cent increase in tax revenue collection next year without any changes in the tax structure or collection system. “This looks like wishful thinking or maybe this target was fixed because it would be acceptable for the IMF keeping in view their conditions,” he said.

He said the government reduced the power sector subsidy from Rs200 billion to Rs124 billion, which will be harmful for the sector. The independent power producers may go into default and as a result electricity tariffs might increase.

The agriculture sector provided the silver lining in last year’s government performance as the only sector with a positive growth of 2.74%. However, now the sector is facing threat from locust attacks and the government needs to make more provisions. The other threat to the sector is from more than normal floods expected this year due to climate change. Due to these factors he was not too hopeful about the outlook for the agriculture sector.

Discussing the pressures in which the current budget has been made, Zafar-ul-Hassan Almas, Chief Macroeconomics, Planning Commission of Pakistan said the financial constraints can be seen in the federal budget and how the government aims to support growth with a large fiscal deficit is beyond comprehension.

He explained that the federal government’s revenue – after paying the due share of provinces – was a meagre 3.7 billion approximately. The government will actually start its business with a deficit of Rs1 trillion!

In addition, he said, the provinces, despite having autonomous powers of managing most of their issues post 18th amendment and getting major share of revenues from federal collections, still look towards the federal government in dealing with the calamities like pandemic.

He said that the exports at present were showing a very grim situation and remittances too were declining due to the pandemic. The bankruptcy of various small entities due to the outbreak of pandemic also needed immediate intervention of the government. One of the positive developments however compared to the previous year was a significant increase in FDI (Foreign Direct Investment), whereas the declining trends in inflation and low policy rate may also provide some relief to the public, he stated.

Almas said more than 70 per cent of the growth handles including agriculture, industrial policy, services, etc. rest with the provinces. As such the provincial budgets will determine whether they support the country’s growth policy.

He was of the view that the situation after the pandemic ends will be important in the sense that how much hand-holding is done by the federal government. A lot of bankruptcies are expected while the SME sector is in dire straits. Meanwhile, the rising locust attacks are the main threat to growth of the agriculture sector and its future depends on how successfully the government handles the issue.

The provinces have traditionally been dependent on the federation despite the 18th Amendment and due to Covid-19 and locust attacks they are again seeking help from the federal government.

Syed Muhammad Ali, senior research fellow at IPS was of the opinion that Pakistan should collaborate with other countries affected by locust swarms to make provisions in a more effective way during budget-making.

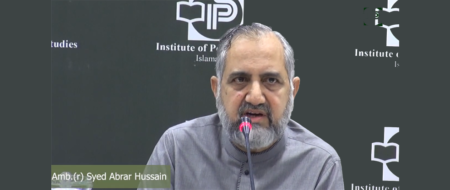

Ambassador (retd)Tajammul Altaf, senior IPS associate said the size of the “Covid budget” has been set at Rs7.137 trillion of which 41% would be spent on repayment of loans and 12.7% on defense, which is more than half of the total. Unless there is a concerted effort to reduce loans even the best budget-maker in the world would not be able to move things in the right direction.

Dr Atiquzzafar Khan, former DG International Institute of Islamic Economics, International Islamic University, Islamabad and Dr Anwar Shah, Assistant Professor Quaid-i-Azam University, Islamabad also presented their views on the occasion.