‘Sustainable Development Aspects of Islamic Finance’

Download Detailed Brief |

Islamic finance provides best alternative to the issues of conventional financial system: Prof Monzer Kahf

Islamic Finance has an inherent element of stability and sustainability that reflects in all dimensions, if adopted properly, and provides the best alternative solution to the challenging issues of the conventional financial system, according to Prof Monzer Kahf.

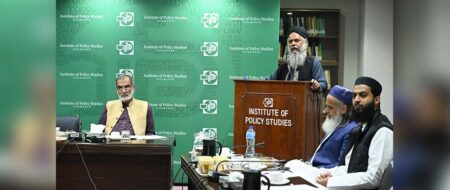

The professor of Islamic finance and economics at Istanbul Sabahattin Zaim University was speaking during an online lecture titled ‘Sustainable Development Aspects of Islamic Finance’ organized by IPS on October 12, 2022.

He upheld that stability and sustainability are closely interrelated and overlap in most of the ingredients of a financial system. With instability comes unsustainability. And the instability of financial systems, according to Prof. Monzer, comes from the nature of financial relationships and the capitalist financial system.

He pointed out that interpersonal relationship uncertainties are a major factor causing instability, along with weak governance, bad supervision, macroeconomic problems, and currency exchange issues. The capitalist system has added a lot to this natural instability as there is excessive indebtedness in capitalism which leads to systemic risks, resulting in financial crisis and breakdown of the entire financial system.

Moreover, in capitalism, banking institutions are connected so heavily that the failure of a bank causes a systemic domino effect which ultimately ends with pulling down of entire chain of lending banks. This instability is further aggravated by the prevalent hesitation and contradiction in the financial industry’s regulatory behaviors and approaches.

As opposed to capitalism, he underscored that Islamic finance, as a system based on realism, justice, and morality, has inherent elements of both sustainability and stability. Bearing a close connection to the just and moral real economy, Islamic finance is an inclusive property-based finance, having a developmental approach, with no domino effect and debt trading, in which return on financing is determined in the real market.

He further asserted that Islamic finance serves economic and social justice as it works by owning assets, rather than debts, and developing a relationship based on partnership and risk sharing, rather than risk transfer, in Islamic banks. It also serves morality by financing useful products and utilizing funds for just, moral, developmental, and society-friendly causes.

This inherent stability and sustainability of the Islamic finance system was proved by the resilience of Islamic banks during the 2008 financial crisis as concluded by several studies using financial stability indicators and World Uncertainty Index (WUI). The same resilience and stability was demonstrated during the Covid-19 pandemic when the Islamic banking sector and Islamic funds continued to grow. On the contrary, other studies suggest that there is no statistically significant difference between the impact placed on Islamic banks and other conventional banking institutions of similar size due to financial collapse.

But, according to Prof Monzer, the impact came through customer dealing, where Islamic banks had to deal with both Islamic and conventional banking, as well as the laws of some countries which permitted Islamic banks, along with conventional banks, to own and trade in real estate. And when prices of real estate went down in countries like the UAE, Qatar, Bahrain and Kuwait, the Islamic banks also went into loss.

Thus, Islamic finance is not just theoretically but also practically stable and resilient, depending on certain environmental and other factors. As the way forward, he concluded that there is a need to introduce reforms in finance and address the issues through the implementation of key principles of Islamic finance: property theory of Islamic finance, realism reflected in Islamic financial transactions, and moral commitment reflected in Islamic finance contracts.

Download Detailed Brief |

|

IPS TV |

| Stability and Sustainability of Islamic Finance | Dr Monzer Kahf (Islamic Economist)

< |